Can You Take Section 179 On An Air Conditioner? Maximize Tax Savings

Yes, you can take Section 179 on an air conditioner. The air conditioner must be for business use and meet eligibility requirements.

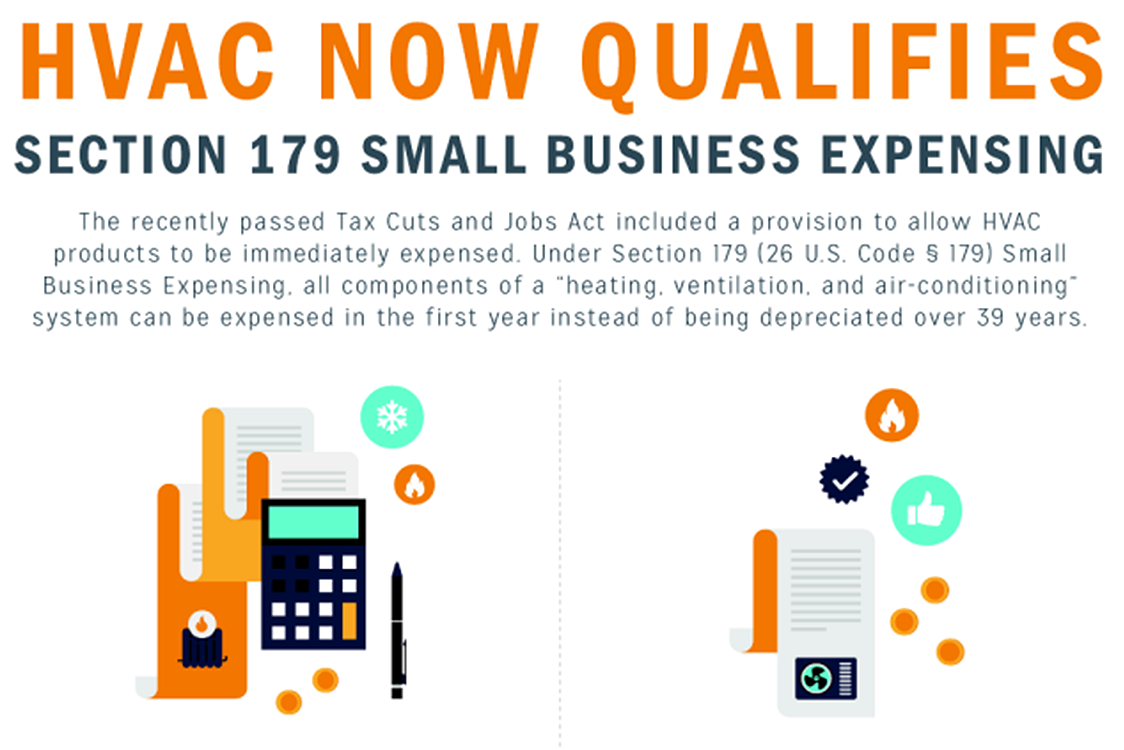

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment, including air conditioners, during the tax year. This deduction is intended to encourage businesses to invest in new equipment by offering immediate tax benefits.

To qualify, the air conditioner must be used for business purposes more than 50% of the time and placed into service in the same tax year. Proper documentation and adherence to IRS guidelines are essential for claiming this deduction. Businesses can benefit significantly from this tax provision, making it easier to upgrade essential equipment like air conditioners.

Credit: admorhvac.com

Section 179 Basics

The Section 179 deduction is a tax code that allows businesses to deduct the full purchase price of qualifying equipment and software. This can include items like air conditioners, which are essential for business operations. Understanding the basics of Section 179 can help you make informed decisions about your business expenses.

Introduction To Section 179

Section 179 is a part of the IRS tax code. It allows businesses to deduct the cost of certain types of property. This includes machinery, equipment, and software. The deduction is taken in the year the property is placed in service.

This helps businesses reduce their tax burden significantly. The deduction can be a huge financial benefit. It encourages businesses to invest in themselves. The maximum deduction limit may vary each year.

Eligibility Criteria

Not all purchases qualify for Section 179. Here are the basic eligibility criteria:

- The property must be tangible.

- The property must be used for business purposes more than 50% of the time.

- The property must be purchased, not leased.

- The property must be placed in service during the tax year you are claiming the deduction.

Let’s look at a table summarizing these points:

| Criteria | Requirement |

|---|---|

| Tangible Property | Must be tangible |

| Business Use | Used over 50% for business |

| Purchased | Must be purchased |

| Service Year | Placed in service during the tax year |

If your air conditioner meets these criteria, you can likely claim it under Section 179. This can lead to significant savings on your taxes. Always consult with a tax professional to ensure you qualify.

Qualifying Property

Understanding what constitutes qualifying property under Section 179 is crucial. It determines if your air conditioner can be expensed immediately. Section 179 allows businesses to deduct the cost of certain types of property as an expense. This helps reduce the overall taxable income.

Air conditioners can qualify as Section 179 property if they meet specific criteria. The property must be used for business purposes more than 50% of the time. Let’s break down the types of qualifying property and special cases.

Types Of Property

There are different types of property that qualify under Section 179. They include:

- Tangible personal property: This includes machinery, equipment, and furniture.

- Off-the-shelf software: Software you purchase and use in your business.

- Qualified real property: Improvements to non-residential buildings like roofs, HVAC, and security systems.

Air conditioners fall under the qualified real property category. They need to be part of an improvement to a non-residential building. The air conditioner should be new or used but new to your business.

Special Cases

Some special cases might affect the qualification of your air conditioner. These include:

- Leased Property: If you lease the property, you might still qualify for Section 179.

- Business and Personal Use: The air conditioner must be used for business more than 50% of the time.

- Placed in Service: The property must be placed in service during the tax year you claim the deduction.

It’s important to keep accurate records of the use and installation date. This ensures compliance with the IRS requirements. Always consult with a tax advisor to confirm your air conditioner qualifies for Section 179.

Air Conditioners And Section 179

Many business owners wonder about the benefits of Section 179. A common question is whether air conditioners qualify. This section will explore the eligibility and IRS guidelines. Understanding these can help businesses maximize their tax benefits.

Eligibility Of Air Conditioners

Not all air conditioners qualify for Section 179. The IRS has specific rules. The air conditioner must be used for business purposes. It must be tangible property. Personal air conditioners do not qualify. Commercial units are more likely to be eligible.

Businesses must ensure the unit is installed and in use during the tax year. The air conditioner must be new or used but new to the business. Leased units are not eligible for Section 179. The cost must be within the annual deduction limit.

Irs Guidelines

The IRS provides clear guidelines for Section 179. The air conditioner must be purchased or financed. It must be used more than 50% for business. The cost of the air conditioner can be deducted fully or partially.

Businesses should maintain proper records. The IRS may require proof of purchase and usage. The air conditioner must be listed as business property. Proper classification is crucial for claiming the deduction.

Example Table Of Deduction Limits

| Year | Deduction Limit |

|---|---|

| 2023 | $1,080,000 |

| 2024 | $1,160,000 |

To maximize benefits, consult with a tax professional. They can guide you through the process. Proper planning can lead to significant savings.

Calculating Deductions

Understanding how to calculate deductions for your air conditioner is crucial. This section provides a detailed guide on this topic. Calculating deductions can save you money on taxes. Let’s dive into the details of deduction limits and the difference between depreciation and Section 179.

Deduction Limits

The IRS sets specific limits on Section 179 deductions. For 2023, the maximum deduction limit is $1,160,000. The total amount of equipment purchased cannot exceed $2,890,000. If your air conditioner costs less than these limits, you can deduct its full cost.

| Year | Max Deduction | Total Purchase Limit |

|---|---|---|

| 2023 | $1,160,000 | $2,890,000 |

Check the IRS website for updates on these limits. Always ensure your deductions comply with IRS rules. This will help you avoid any penalties.

Depreciation Vs. Section 179

Depreciation spreads the cost of the air conditioner over several years. This method is useful for expensive equipment.

- Depreciation is calculated annually.

- The asset value decreases each year.

- Useful for long-term financial planning.

Section 179 allows you to deduct the full cost in the year of purchase. This method is beneficial for immediate tax savings.

- Instant deduction in the purchase year.

- Reduces taxable income quickly.

- Ideal for small businesses.

Choose the method that fits your financial needs. Both options offer valuable tax benefits. Consult a tax professional for personalized advice.

Installation Costs

When considering Section 179 for an air conditioner, installation costs matter. These costs impact your overall expense and potential deductions.

Inclusion Of Installation

Does Section 179 include installation costs? Yes, it does. The IRS allows including installation costs in your deduction. This means you can deduct both the price of the air conditioner and its installation. The total amount you spend on the air conditioner and its installation can be deducted, making it a significant tax benefit. This inclusion helps lower your taxable income more effectively.

Additional Expenses

Besides the installation, other related expenses can be included. These might involve:

- Labor Costs: Fees paid to technicians or contractors.

- Material Costs: Wires, ducts, and other necessary materials.

- Permits: Any required permits for installation.

- Inspection Fees: Costs for ensuring the system is up to code.

Including these additional expenses in your Section 179 deduction maximizes your tax savings. Always keep detailed records of these expenses. Accurate documentation ensures you can claim these costs without issues.

Quick Summary

| Expense Type | Includable under Section 179? |

|---|---|

| Air Conditioner Unit | Yes |

| Installation Labor | Yes |

| Material Costs | Yes |

| Permits | Yes |

| Inspection Fees | Yes |

Remember, taking full advantage of Section 179 requires careful planning. Consult with a tax professional to ensure you’re maximizing your deductions properly.

Credit: fivestarmech.com

Tax Planning Tips

Tax planning is crucial for maximizing financial benefits. Understanding how to leverage tax codes can save significant amounts of money. One important area is Section 179. This allows businesses to deduct the full purchase price of qualifying equipment. This includes air conditioners. Here are some essential tax planning tips to help you take advantage of Section 179 on an air conditioner.

Timing Of Purchases

Timing is everything in tax planning. To fully benefit from Section 179, purchase your air conditioner within the tax year. This means you must buy and install the air conditioner before December 31. This ensures it qualifies for the deduction in the current tax year.

Plan your purchases wisely. If you buy and install the air conditioner in January, you will have to wait until the next tax year to claim the deduction. Therefore, consider making the purchase towards the end of the year.

Maximizing Deductions

Maximizing deductions involves careful planning. Section 179 has a deduction limit. For 2023, the limit is $1,050,000. This is the maximum you can deduct in one year. If your air conditioner costs less than this, you can deduct the full amount.

Here’s a table to illustrate:

| Purchase Price | Deduction Amount |

|---|---|

| $5,000 | $5,000 |

| $50,000 | $50,000 |

| $1,200,000 | $1,050,000 |

Additionally, ensure your business income supports the deduction. Section 179 deductions cannot exceed your total business income. If your business income is $500,000, you cannot deduct more than this amount. Plan your purchases to match your income levels.

Using these tax planning tips, you can maximize the benefits of Section 179 on your air conditioner purchases. This will help you save money and improve your business’s cash flow.

Case Studies

Understanding how Section 179 applies to air conditioners can be tricky. Real-world examples help. Here, we explore case studies from both small businesses and large corporations.

Small Business Examples

Small businesses often benefit greatly from Section 179 deductions. Let’s see some examples.

| Business Type | Air Conditioner Cost | Tax Savings |

|---|---|---|

| Retail Store | $5,000 | $1,250 |

| Restaurant | $8,000 | $2,000 |

| Office Space | $3,500 | $875 |

- Retail Store: A small retail store spent $5,000 on a new air conditioner. The owner saved $1,250 on taxes.

- Restaurant: A restaurant upgraded its air conditioning for $8,000. This resulted in $2,000 in tax savings.

- Office Space: A small office installed a new unit costing $3,500. The tax saving was $875.

Corporate Use Cases

Large corporations can also benefit from Section 179. Here are some examples.

| Company Type | Air Conditioner Cost | Tax Savings |

|---|---|---|

| Tech Company | $50,000 | $12,500 |

| Manufacturing Plant | $75,000 | $18,750 |

| Corporate Office | $30,000 | $7,500 |

- Tech Company: A tech firm spent $50,000 on a new system. This led to $12,500 in tax savings.

- Manufacturing Plant: A plant invested $75,000 in air conditioning. They saved $18,750 on taxes.

- Corporate Office: A corporate office installed a unit costing $30,000. The tax saving was $7,500.

Credit: gopaschal.com

Common Mistakes

Taking Section 179 on an air conditioner can be complex. Many business owners make mistakes that can lead to issues with the IRS. Below, we cover common mistakes and how to avoid them.

Avoiding Audit Triggers

One common mistake is not understanding what triggers an audit. The IRS closely watches large deductions like Section 179. Make sure your deduction is reasonable. Avoid overestimating the cost of your air conditioner. Always use the actual purchase price.

Another mistake is mixing personal and business expenses. Only business-used air conditioners qualify for Section 179. Do not claim a home air conditioner as a business expense. This can trigger an audit.

Documentation Requirements

Proper documentation is key to avoiding mistakes. Keep all receipts and invoices for your air conditioner purchase. Ensure the date of purchase is clear. The air conditioner must be put into service during the tax year you claim it.

Maintain a detailed record of how the air conditioner is used in your business. This includes logs, maintenance records, and usage reports. Having thorough documentation can prevent issues during an audit.

| Common Mistakes | How to Avoid |

|---|---|

| Overestimating the Cost | Use the actual purchase price |

| Mixing Personal and Business | Only claim business-used air conditioners |

| Poor Documentation | Keep all receipts and usage records |

- Always be honest about the business use of the air conditioner.

- Ensure the air conditioner is put into service in the correct tax year.

- Keep detailed records of all related expenses and usage.

Frequently Asked Questions

What Is Section 179 On An Air Conditioner Unit?

Section 179 allows businesses to deduct the full purchase price of qualifying air conditioning units. This tax deduction helps reduce overall taxable income. To qualify, the equipment must be purchased and put into service during the tax year. This incentive encourages businesses to invest in energy-efficient equipment.

What Is The Depreciation Method For Ac Unit?

The straight-line depreciation method is commonly used for AC units. This method spreads the cost evenly over its useful life.

Can You Write Off An Air Conditioner?

Yes, you can write off an air conditioner if it’s used for business purposes. Always consult a tax professional.

Conclusion

Determining if Section 179 applies to your air conditioner can save you money. Check eligibility before making a purchase. Consult a tax professional to ensure compliance and maximize benefits. An informed decision can lead to significant tax savings for your business.

Stay updated on tax laws for optimal financial planning.